Google is again in the limelight recently. Google stock price exceeds 400$ per share, and market value hits 120 billion. It has been the fourth largest tech company, and the third largest NASDAQ trade company (only inferior to Microsoft and Intel. IBM is traded in New York Stock Exchange Market) in terms of market value in the stock market. It seems that the image of crash of dot com and tech stocks in 2001 are still fresh, and NASDAQ is still in the swamp, how come Google is at full blast? Will Google lead the advent of so-called web 2.0?

Google is again in the limelight recently. Google stock price exceeds 400$ per share, and market value hits 120 billion. It has been the fourth largest tech company, and the third largest NASDAQ trade company (only inferior to Microsoft and Intel. IBM is traded in New York Stock Exchange Market) in terms of market value in the stock market. It seems that the image of crash of dot com and tech stocks in 2001 are still fresh, and NASDAQ is still in the swamp, how come Google is at full blast? Will Google lead the advent of so-called web 2.0?I looked up today’s stock prices of both Google and Yahoo. Google’s is 410.9395$ per share, and Yahoo’s is 42.27$ per share. Their market values are 120.99B$ and 59.97B$ respectively. Google’s market value has almost amounted to the sum of that of Yahoo and EBay (64.38B$).However, if making a comparison between Google’s traffic, and income, and Yahoo’s traffic and EBay’s income, we can find that Google’s gross profit (1.73B) is lower than that of Ebay (2.66B), and Google’s traffic is lower than Yahoo, based on Alexa and Nielson/Netratings. (According to Alexa, Google ranks No.3 under Yahoo and MSN. According to Netratings, Google (190,598,000) also ranks No.3 under yahoo (194,999,000) and Microsoft (236,509,000) in the rankings of world’s most visited websites excluding China. I should redundantly add that Alexa’s method has many limitations, because it depends on the numbers of downloaded program which counts the traffic. Yet many work people can’t install it; its samples are biased. Netratings’ method is much like What AC Nielsen has been doing in the TV rating, which employs many random samples in many cities to fill in diaries or press “people meter”. ).

Does it imply the dusk of the old dot com represented by Yahoo, and dawn of the new web2.0 represented by Google? If we analyze the NASDAQ Index in the past years, we found that the peak of NASDAQ Composite Index was 5048.62 in Oct. 2000, and the nadir of NASDAQ index after peak was 1114.11 in Oct. 2002. Current NASDAQ index is 2241.67. However, how about Google’s price? I think it’s a little bit overvalued, but not too much.

Some Wall Street analysts said Google’s price would hit 500$ a share in the next 12 months . In my view, that's one of the major reasons why Google is blasting off, that is, investment analysts might mislead the investors somehow. If we look up the trade history of major stock prices in NASDAQ, we’ll find Yahoo had achieved the peak trade price at 433.29$ in Dec. 1999 (its highest open price was once over 500$), even after its stock was split three times. If we went back to Jan. 1999, when NASDAQ Index was near to present price, Yahoo price was 354.25$

a share. If we considered into the factor of stock split, it could be near to present Google’s stock trade price. Until now, it seems that we are substantiating its rationality of high price. No, don’t forget current Yahoo’s price (42$). Google’s price couldn’t be so high. Google must split its stock, and make its price under 100$ a share. However, based on my observations on Google, it will have much better performance than Yahoo. Next, I’ll talk about them.

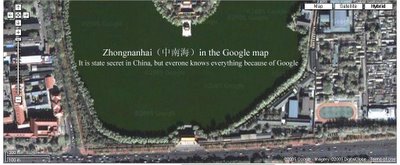

a share. If we considered into the factor of stock split, it could be near to present Google’s stock trade price. Until now, it seems that we are substantiating its rationality of high price. No, don’t forget current Yahoo’s price (42$). Google’s price couldn’t be so high. Google must split its stock, and make its price under 100$ a share. However, based on my observations on Google, it will have much better performance than Yahoo. Next, I’ll talk about them.Google has better global competitive strategy than Yahoo in terms of confronting with the censorship of totalitarian countries. We know Yahoo surrendered its client’s (Shi Tao, I ever talk about in the story below) personal information to Chinese government, and led to its client be jailed. I know many people said Google also helped Chinese government to filter some sensitive websites. Actually, I need to applaud what Google did, because it didn’t do that foolishly as Yahoo did. What Google did is to distinguish where users are by technical analysis. For example, if a website is blocked in China, and you visit the website from China; Google won’t show the website to you. However, if you visit the same blocked website in China by means of overseas proxy server, you'll see the website normally. That’s great! Google doesn’t need to offend Chinese government by its smart technology. Another case is Google map (it has been changed to Google Local). We know Taiwan government protested that Google called Taiwan is a province of China in the Map service. Google later on didn’t show any texts. When Beijing government protested, Google just said we had a strategic recap. Google easily survived these crisis, on the other side, that expounds there is a new dispute in the Google Sovereignty. That’s amazing! Continue......

No comments:

Post a Comment